Canada, Japan Led Foreign Surge in Treasuries Buying in February

Canada, Japan Led Foreign Surge in Treasuries Buying in February Read More »

Canada, Japan Led Foreign Surge in Treasuries Buying in February Read More »

Federal Reserve Chair Jerome Powell said he doesn’t believe a high-profile Supreme Court case over former President Donald Trump’s dismissal of two Democrats from federal labor boards poses a threat to the Fed’s independence. Speaking at the Economic Club of Chicago, Powell acknowledged the case is being closely watched but said, “I don’t think that decision will apply to the Fed.”

Background to this is here:

Powell emphasized that the Fed operates independently of political pressure and reaffirmed its commitment to making policy decisions based solely on data and analysis to fulfil its dual mandate. “We’re never going to be influenced by any political pressure,” Powell said.

The case, involving Cathy Harris and Gwynne Wilcox, has raised concerns that a Supreme Court ruling in Trump’s favour could weaken safeguards protecting independent agencies like the Fed. Lawyers for Harris warned the decision could open the door to political interference at the central bank.

Powell said the Fed’s independence remains “widely understood and supported” across Washington, including in Congress.

Under current law, Fed governors—appointed by the president and confirmed by the Senate—can only be removed “for cause,” not over policy disagreements.

As for policy remarks, this from earlier:

This article was written by Eamonn Sheridan at www.forexlive.com.

Powell downplayed risk to Fed independence from Trump firings case Read More »

Financial Times reporting:

The FT is gated but Reuters supply some summary infor:

This article was written by Eamonn Sheridan at www.forexlive.com.

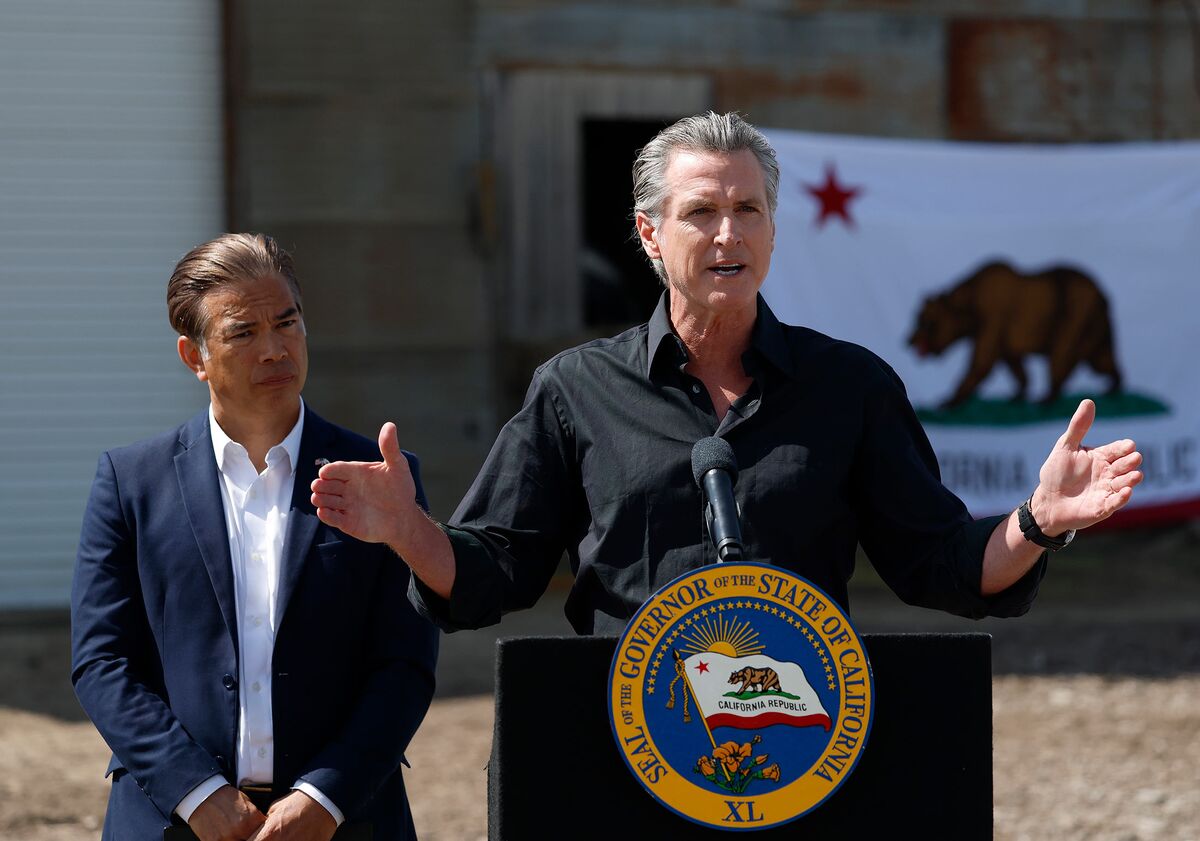

Newsom to Cut California Budget As Trump’s Trade War Crimps Economic Outlook Read More »

US stocks are closing mostly lower but rarely modestly into the close. It could’ve been worse:

Shares of Nvidia moved down sharply by $7.71 or -6.87% at $104.49.

Other big losers included:

This article was written by Greg Michalowski at www.forexlive.com.

US stocks close lower but rally modestly into the close Read More »

Omers Loaded Up on Stocks After Trump’s Tariffs Pummeled Markets Read More »

New Zealand inflation data and Aussie jobs report are a couple of focal points for the calendar ahead.

The slight tick higher expected for NZ CPI will not prevent further rate cuts from the Reserve Bank of New Zealand. Not in this tariff-war-led pre-recession environment.

Last month’s Australian jobs report showed a substantial drop in jobs, expected to be partially reversed today. Hmmm. Let’s see about that!

As a caveat to both these reports, they are for pre-April, i.e. they don’t capture the initial impact of Trump’s Liquidation Liberation Day reciprocal tariff economic destruction.

This snapshot from the ForexLive economic data calendar, access it here.

The times in the left-most column are GMT.

The numbers in the right-most column are the ‘prior’ (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.

This article was written by Eamonn Sheridan at www.forexlive.com.

Economic calendar in Asia Thursday, April 17- Fed speaker, NZ CPI, Australia jobs report Read More »

CDC Panel Votes to Expand RSV Vaccine Use in Older Adults Read More »

Fed’s Powell to Volatile Stock Market: You’re on Your Own Read More »

TPG Hires EQT Infrastructure Partner Juan Diego Vargas Read More »